MUHAMMED SHEREEF AMEKKALA YOOSUF AMEKKALA

Unknown Designation

Member since August 16, 2025Posts

Connections

Follower

Followings

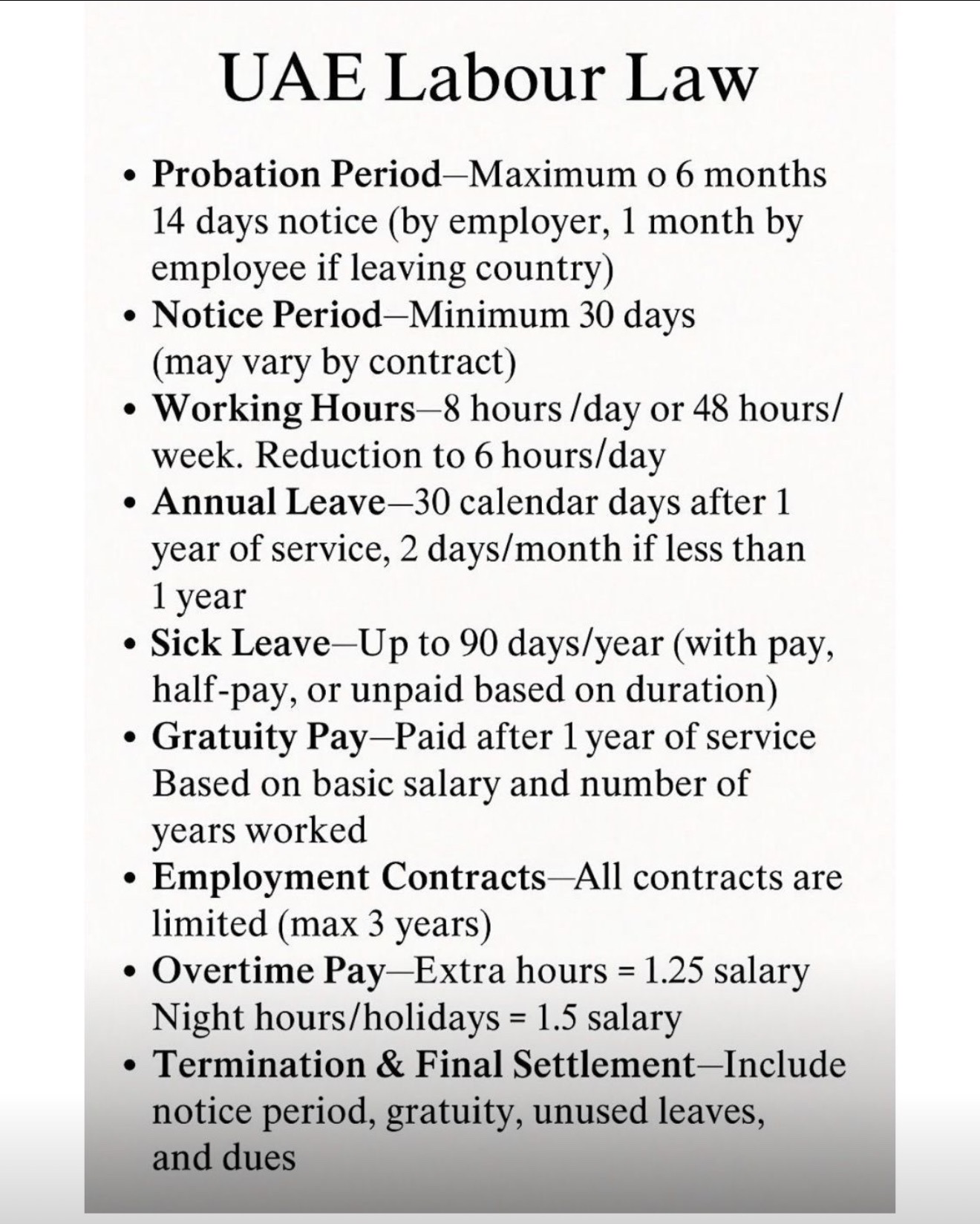

UAE Labour Law

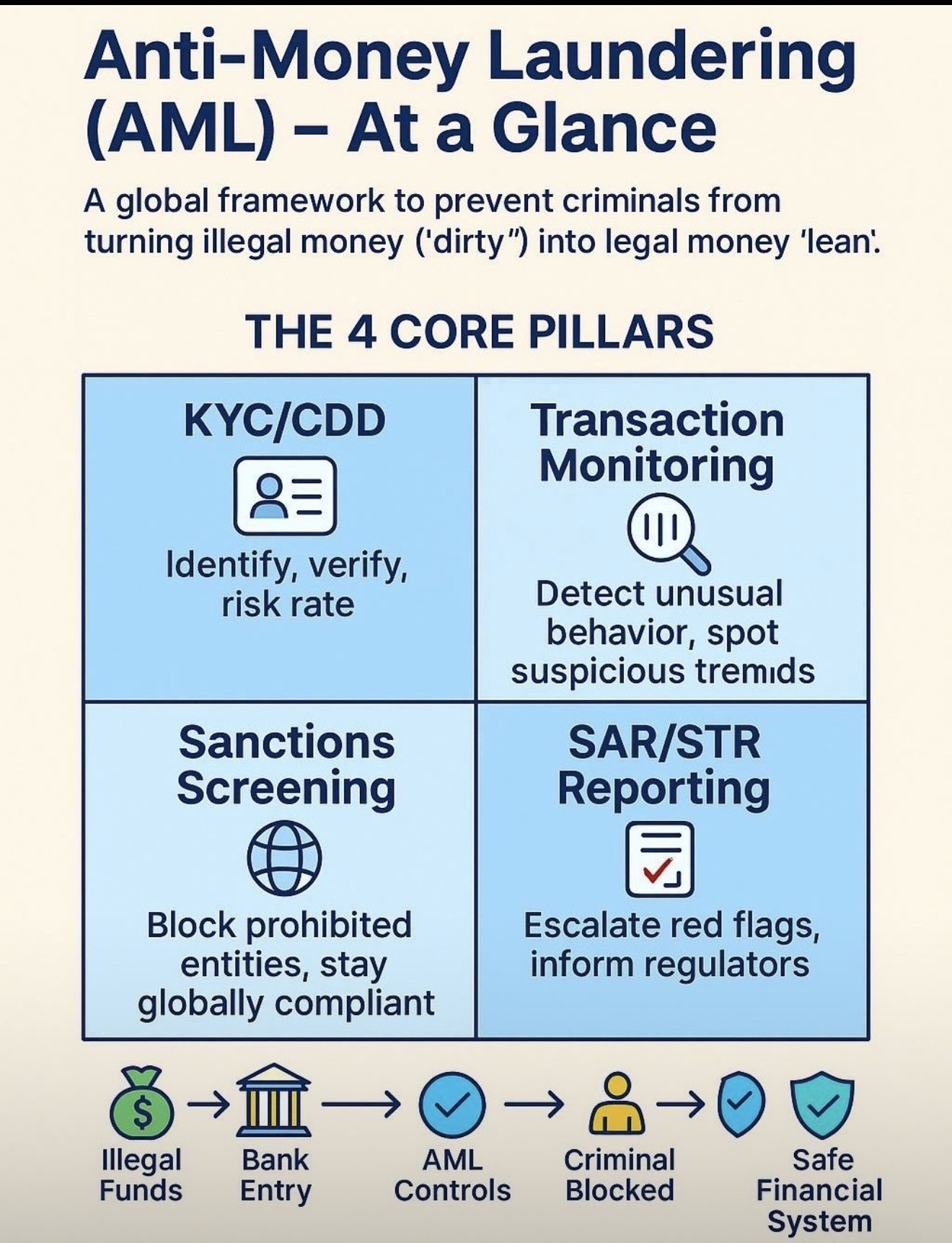

🚨 AML at a Glance – 4 Core Pillars 🚨

Job Alert

🚨 Hiring Alert! - Front Line Associate

Salary: 4,000–7,000 AED

Location: UAE

Apply Now: hr @ jaziraexchange . com

🔹 Key Responsibilities:

• Provide outstanding customer service and handle financial transactions at the counter.

• Assist customers with remittance, foreign exchange, and other financial services.

• Verify customer documents in line with AML/KYC and compliance requirements.

• Maintain accurate transaction records and handle daily cash balancing.

• Promote financial services and build strong customer relationships to meet business targets.

🔹 Requirements:

• A Bachelor’s degree or Diploma in any discipline.

• Previous experience as a Cashier or Teller in a UAE Exchange House or Bank is preferred.

• Strong numerical and communication skills.

• Knowledge of UAE AML/KYC regulations is an advantage.

• A customer service-oriented mindset with excellent attention to detail.

📧 Send your resume to: hr @ jaziraexchange . com

🚨 Red Flags in Transaction Monitoring – Must-Know for AML Edge Students 🚨

In Transaction Monitoring, spotting red flags early can be the difference between preventing financial crime and missing a critical risk. Some key red flags every compliance professional should know:

🔴 Unusual transaction patterns not matching customer profile

🔴 Multiple small deposits (structuring/smurfing)

🔴 Transactions involving high-risk countries or tax havens

🔴 Sudden spikes in account activity or round-number transactions

🔴 Links to sanctioned entities, PEPs, or negative media

🔴 Use of virtual assets, mixers, or suspicious crypto wallets

👉 Remember: A red flag doesn’t always mean wrongdoing—but it’s a signal for deeper investigation and due diligence.

💡 As future AML specialists, mastering these indicators will sharpen your ability to detect, escalate, and resolve suspicious activity effectively.

Let’s build a community where learning red flags = saving institutions from financial crime 💼🌍

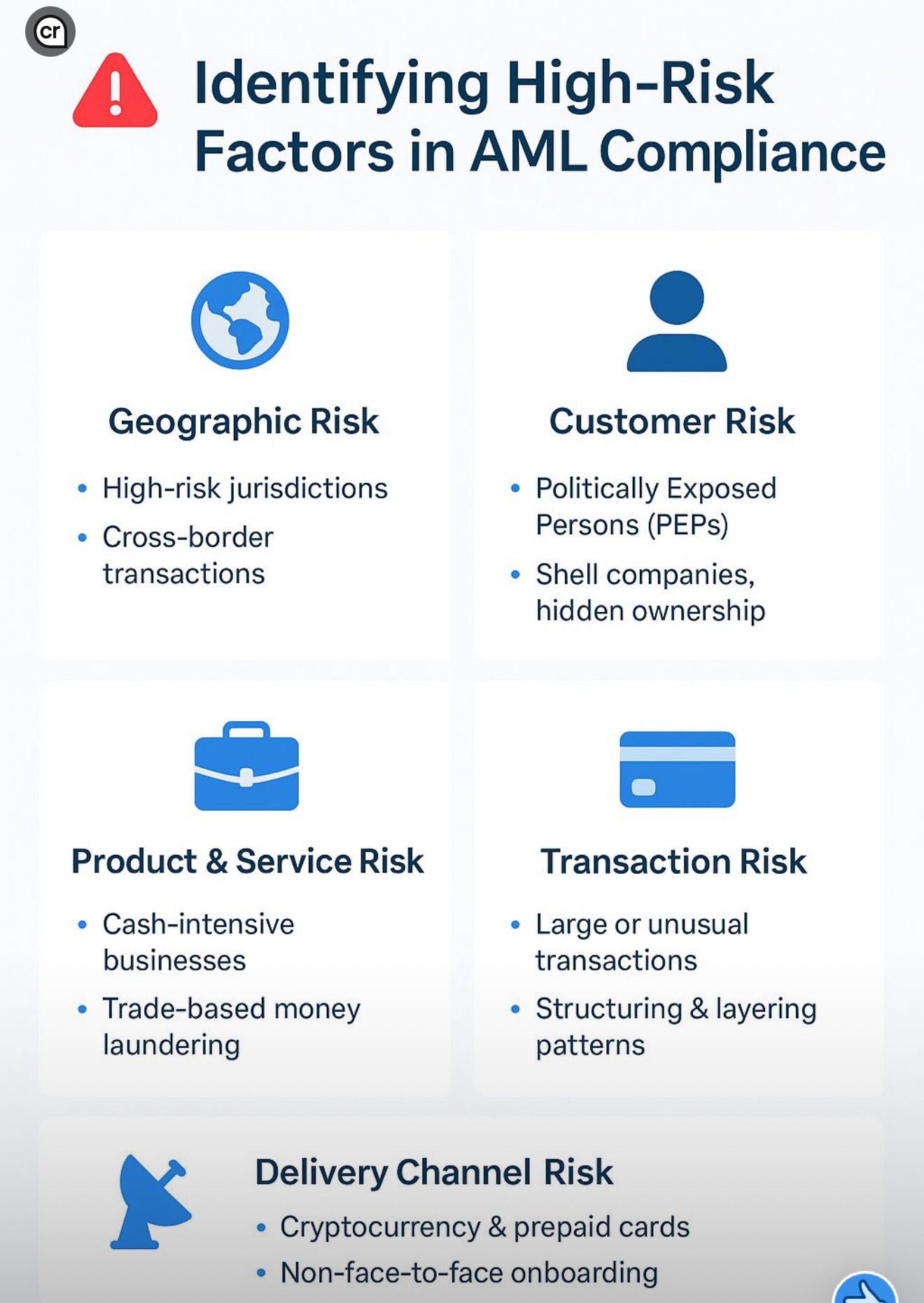

🚨 Identifying High-Risk Factors in AML Compliance

✅ Why It Matters:

Identifying and mitigating these risks not only ensures regulatory compliance, but also helps build trust, safeguard financial stability, and prevent criminal exploitation of the financial system.

💡 Takeaway: A robust AML framework is not just about compliance—it’s about proactively identifying high-risk factors and acting on them before they turn into threats.

Personal Info

Name | MUHAMMED SHEREEF AMEKKALA | Job Title | Compliance Officer |

|---|---|---|---|

Date of birth | 22-05-1989 | Gender | Male |

Marital Status | Married | Country | UAE |

Nationality | India | Qualification | Batchelor/ Higher |

Industry | Bank & Finance | Designation | |

Expected Salary | 0 | Lanaguages |

Work Experiences

Educations

-

Graduation Year : 2011

Batchelor/ Higher - MBA

VTU , India

Skills

UAE Labour Law

🚨 AML at a Glance – 4 Core Pillars 🚨

Job Alert

🚨 Hiring Alert! - Front Line Associate

Salary: 4,000–7,000 AED

Location: UAE

Apply Now: hr @ jaziraexchange . com

🔹 Key Responsibilities:

• Provide outstanding customer service and handle financial transactions at the counter.

• Assist customers with remittance, foreign exchange, and other financial services.

• Verify customer documents in line with AML/KYC and compliance requirements.

• Maintain accurate transaction records and handle daily cash balancing.

• Promote financial services and build strong customer relationships to meet business targets.

🔹 Requirements:

• A Bachelor’s degree or Diploma in any discipline.

• Previous experience as a Cashier or Teller in a UAE Exchange House or Bank is preferred.

• Strong numerical and communication skills.

• Knowledge of UAE AML/KYC regulations is an advantage.

• A customer service-oriented mindset with excellent attention to detail.

📧 Send your resume to: hr @ jaziraexchange . com

🚨 Red Flags in Transaction Monitoring – Must-Know for AML Edge Students 🚨

In Transaction Monitoring, spotting red flags early can be the difference between preventing financial crime and missing a critical risk. Some key red flags every compliance professional should know:

🔴 Unusual transaction patterns not matching customer profile

🔴 Multiple small deposits (structuring/smurfing)

🔴 Transactions involving high-risk countries or tax havens

🔴 Sudden spikes in account activity or round-number transactions

🔴 Links to sanctioned entities, PEPs, or negative media

🔴 Use of virtual assets, mixers, or suspicious crypto wallets

👉 Remember: A red flag doesn’t always mean wrongdoing—but it’s a signal for deeper investigation and due diligence.

💡 As future AML specialists, mastering these indicators will sharpen your ability to detect, escalate, and resolve suspicious activity effectively.

Let’s build a community where learning red flags = saving institutions from financial crime 💼🌍

🚨 Identifying High-Risk Factors in AML Compliance

✅ Why It Matters:

Identifying and mitigating these risks not only ensures regulatory compliance, but also helps build trust, safeguard financial stability, and prevent criminal exploitation of the financial system.

💡 Takeaway: A robust AML framework is not just about compliance—it’s about proactively identifying high-risk factors and acting on them before they turn into threats.

My Portfolios